People who understand how to find investors and succeed at raising capital do three things very well:

- They bounce back from rejection

- They create a great product story

- They know how to reach the right people

Persistence and resilience are key traits of a successful entrepreneur. When you’re raising capital, you will likely get more rejections than signed term sheets. That’s why you have to nurture your ability to bounce back from rejection.

Your product story is important because it’s what you’ll be judged on during your pitch. How much excitement your story generates will determine whether you leave the meeting with a new line of credit or empty pockets. That’s why it’s so important to understand the best practices for pitching your startup to investors.

But all of that is pointless if you can’t get in front of the right people.

You may have an exciting product story, inspiring vision, and talented team, but if you don’t reach the right investors, you’re just wasting valuable time that could be spent designing your packaging or shopping for a mobile app developer.

And that’s why we want to give you a few tips for landing meetings with the people who can fund your startup.

In this blog post, we’ll break down four ways to get on the radar of potential angels or VCs (without being annoying, that is):

1. Generate Early Signs Of Traction

What far too many entrepreneurs don’t realize when raising capital is that investors are looking for more than a pretty product. They want to see signs that you’re a great founder who can execute a vision.

They want to see traction.

Traction comes in many forms. It can be customers who’ve already given you repeat business, trial users signed up for a demo, partnerships with other brands, distribution agreements, media attention, money from other investors or even a few key hires.

Investors respect the opinions of other successful investors and entrepreneurs, so their endorsement is a big indicator of traction. On Quora a few years back, Naval Ravikant, the CEO of AngelList, made a list of the kind of social proof you’re looking for, starting with the best:

- A top-tier investor is publicly willing to invest in this round of the company, and this is either their first investment into the company, or they are doing more than their “pro-rata” in this round. Their investment is on the same exact terms as the new investors that you are soliciting

- A less well-known investor is investing under the criteria above

- A top-tier entrepreneur or advisor is recommending your company and is throwing their time and reputation behind it

- A less well-known entrepreneur or advisor is recommending your company

- An investor is choosing not to invest in your company and is making the introduction for you

But even though a recommendation from a well-respected businessperson can speak volumes, ultimately the investor is putting their money into you.

On his blog, Both Sides of the Table, Mark Suster, founder of Upfront Ventures and former entrepreneur, says that traction “really is about building a relationship with a VC over time and showing them that you can move the ball forward.”

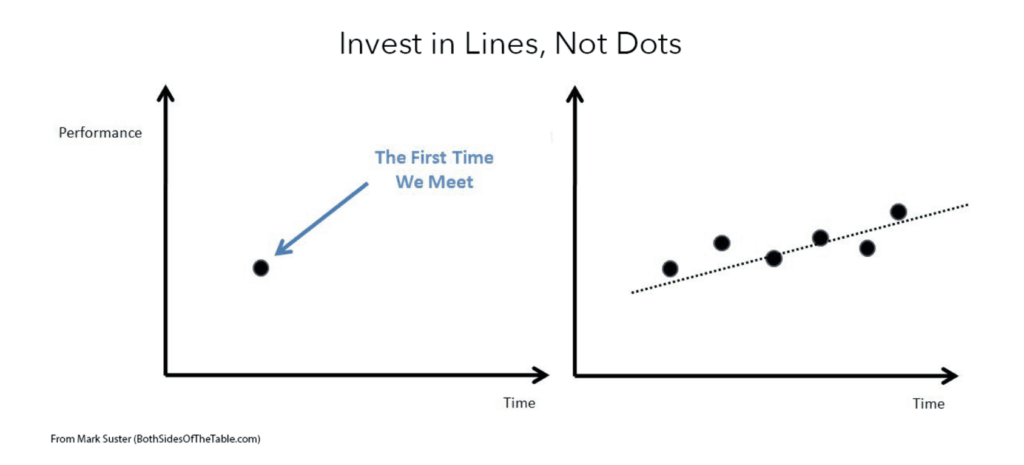

In another piece titled “Invest in Lines, Not Dots,” Suster talks about his approach to investing in founders and shares this visual:

Rather than investing in an entrepreneur based on their first meeting, he wants a few additional check-ins to gauge traction and build a relationship. He explains that as time goes on, each meeting or call helps him understand how well the entrepreneur performs.

To founders raising money, he suggests:

Meet your potential investors early. Tell them you’re not raising money yet but that you will be in the next 6 months or so. Tell them you really like them so you want them to have an early view (which is what all investors want).

We love this advice.

Getting on a potential investor’s radar before you actually start raising capital is a great way to build a non-transactional relationship. It also forces you to keep striving so you can place dots on the board that are moving in the right direction.

2. Seek Out Introductions To Potential Investors

One tried and tested way to connect with a potential investor is through their network. Relationships are the backbone of business and can play a huge role in helping you meet the right people.

But before you start asking for blind introductions to investors, you should identify which investors you actually want to meet. To identify your ideal investors, do some research to see who has invested in companies in your industry (but not companies you’re competing with). For example, if you’re raising money for an AI system that curtails retail theft, look for investors who’ve funded an AI system that tracks farm pesticides.

The internet has made it easier than ever to uncover these ideal investors and even find their emails. Start by browsing sites like CB Insights, Mattermark, and AngelList. On each of these sites, you can drill down into companies and the investors who funded them.

Once you’ve identified investors, tools like the Hunter.io Email Finder allow you to look up their emails online. The Email Finder instantly gathers all kinds of data and spits out the right contact info.

But remember:

Emailing a potential investor cold is the last resort.

The ideal situation is that you and the investor have a shared connection. It could be literally a shared connection on LinkedIn. Or maybe the investor follows someone you know on Twitter. Ask that person for an introduction!

And keep in mind Naval Ravikant’s list of social proof—the more well-known and respected your connection, the better received your introduction will likely be.

3. Generate Buzz In Online Communities

Online communities are powerful corners of the internet. And they’re all around us, from sites for designers like Dribbble and Designer News to app developer hangouts like Hacker News and niche communities of all kinds within Stack Exchange.

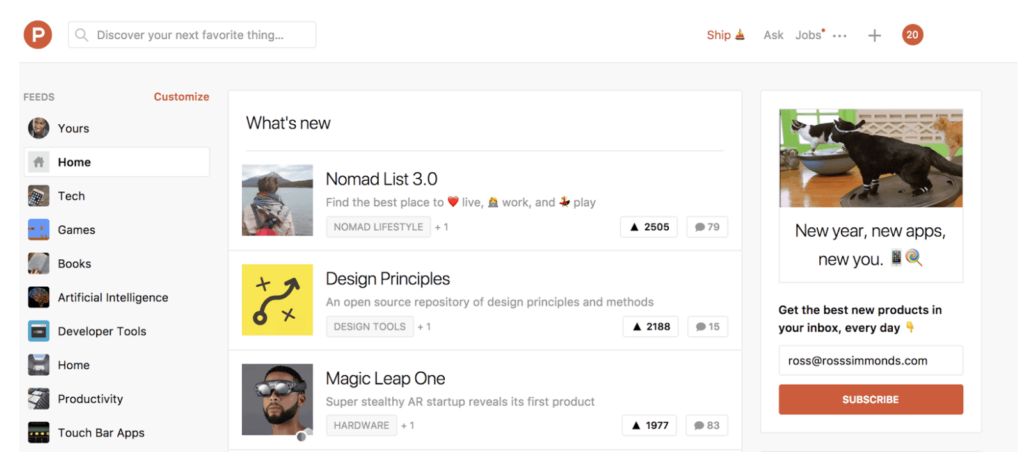

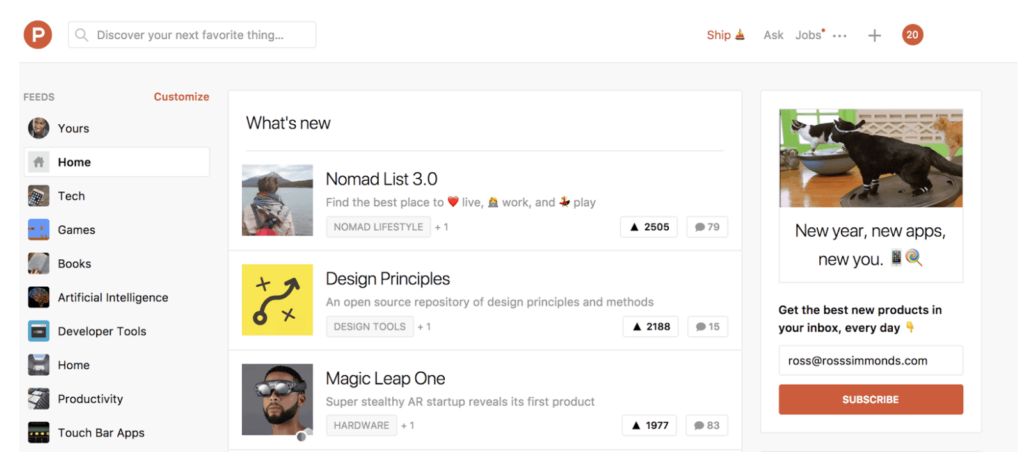

For venture capitalists and angel investors, these communities are often goldmines for digging up the next big thing. Recently, one of the most popular communities for investors to browse for seed-stage startups is Product Hunt:

Every day there are a handful of new apps, websites, digital tools and physical products submitted directly to the site. Then the community votes on the products they like most, and the ones that rise to the top are often viewed by thousands of people.

Product Hunt is frequented by influencers, investors and media professionals from all over the world. Submitting your product to Product Hunt after you’ve taken steps to ensure a successful launch is a sure-fire way to generate buzz and capture the attention of investors who might be a good fit for your startup.

In a similar vein, plenty of VCs browse Hacker News on a regular basis as well. The community lives on the domain of well-known startup accelerator Y Combinator and is considered the birthplace of many successful startups like Dropbox. If you plan to launch your product on Hacker News, we recommend blocking off time in your day to respond to questions from other members in the community.

You never know—you might be replying to a potential investor.

4. Attend Startup Events Near And Far

While there’s no question that technology has made it easy to nurture relationships without ever meeting face to face, there’s still value in those in-person interactions. In fact, the vast majority of investors still believe that face-to-face meetings are important.

A great way to meet potential investors and VCs is to attend startup events—industry conferences, pitch competitions, meetups, etc. These events give you a chance to network with other startups, learn from successful founders, and meet investors face to face.

As you scope out potential events, don’t limit yourself to popular events happening locally. It’s often worth looking outside of your local market (yes, even if you’re in a major hub like Silicon Valley). Besides expanding your opportunities to meet investors, getting out of your local bubble is good for gaining perspective. As Patrick Keefe, a partner at Build Ventures, shared with Atlantic Business: “You’ve got to get on a plane and spend time in the markets you are attacking.”

So What Should You Do Next?

Simple: You act.

Whether that’s simply following a few VCs and angel investors on Twitter or prepping for a big launch on Product Hunt, you have to take action—you won’t get on anyone’s radar by twiddling your thumbs and dreaming of a big investment. Now is the time to start putting those dots on your chart.

As an app development company, we’ve helped plenty of new apps finetune their product and their pitch. If you’re creating an Android app or an iPhone app and need some help reaching a successful launch, get in touch!

We’ve combed through data from CrunchBase and other sources to uncover the investors who have the Midas touch when it comes to mobile. These are the investors who were able to identify the next great apps before the rest of the industry and helped them grow to valuations of $1 billion. Download the FREE list of the 10 top mobile investors today!