Have you ever spent hours crafting what you thought was the PERFECT cold email for a potential investor, only to be met with crickets?

You’re not alone.

The cold-emailing world can be harsh sometimes. You can spend hours tweaking every last word in an email and drive a total of zero follow-up calls.

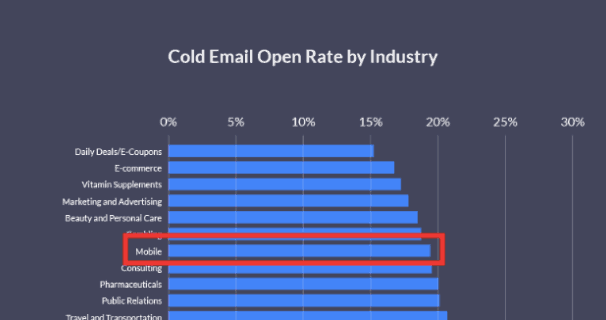

In the mobile app industry, the average open rate for a cold email is less than 20 percent. That means more than 80 percent of all cold emails are deleted before they’re even opened.

So does that mean cold emailing investors is a massive waste of time, and instead you should be spending that time finding investors through shared connections and networking events?

Not at all.

The truth is, cold emailing potential investors isn’t actually as difficult as it may seem. All you need to do is take a step back and shift your approach. From the research stage (yes, there’s a research stage) to the final call-to-action, every cold email you send is going to be focused on accomplishing one thing:

You want to get on the radar of investors in order to set up conversations.

In this post, I’m going to break down the 5 steps you can follow to start sending better cold emails to investors right away. These key steps are:

- Do your research

- Lead with value

- Tell them what you do

- Tell them why they should care

- Set up a conversation

Am I saying a shift in your cold email approach is going to bring you 100 percent open rates? Not quite. The good news is you don’t need a 100 percent open rate to be successful with cold emailing potential investors.

Now let’s talk details.

Step 1. Do your research.

Before you even start piecing together an email to a potential investor, there’s one crucial step far too many founders tend to skip. This first step is what can take your cold email from an instant delete to an interested open.

Here’s the secret:

Research, research, research.

If you don’t do a single drop of research on the investor you’re emailing, all you’re doing is throwing darts in the dark and praying for a miracle.

Think about it: Without conducting any research, how can you expect to know what they want? If you can’t find an angle that will engage them, they’re never going to give you the time of day. You need to understand what the potential investor is interested in, what might make them interested in you, and what unique angle you can take to get your foot in the door.

What companies have they invested in before?

Are there any trends in their investment decisions?

Do they invest in certain industries only?

How much money do they typically invest in a company?

What is the average valuation of the companies they invest in?

What content are they sharing most on LinkedIn?

What topics are they tweeting and retweeting about?

Set yourself up for success by doing the research.

Don’t get caught assuming all investors are created equally. Take the time to do your research on what this particular investor likes and what’s most likely to catch their attention. Before you send any emails, take advantage of platforms like AngelList and Crunchbase to make sure your company is one they might have an interest in investing in.

Step 2. Lead with value.

When it comes to cold emailing an investor, the very first mountain you need to climb is not “How can I get them on the phone?” (And it’s definitely not “How can I get them to invest?”)

The first obstacle is this:

Getting them to open your email.

Again, the average open rate for a cold email is between 15 and 25 percent. That means on average, 75 to 85 percent of all cold emails are deleted before they even get the chance to be read.

If an email lands in an inbox and no one opens it, did it even exist?

In other words, you could have the greatest cold email ever written, but if you can’t get someone to open it, it’s never going to drive any real results for you. Your email will simply be destined for the trash bin the second it arrives.

Let’s be honest here:

The inbox is a very noisy place.

The investors you’re trying to reach are busy people with very busy inboxes filled to the brim with cold emails from startup founders. If all you’re doing is joining the cookie-cutter email template parade, your email is going to get deleted without a second thought.

Using the research you did in the first step, craft a subject line that will help you stand out from the crowd and capture the investor’s attention.

DO NOT SAY: “Mobile App Investment Opportunity”

DO SAY: “Just hit $1m ARR, looking for seed VC”

The key to writing good subject lines is to show the investor value right away, in one sentence. If you’re lucky, the investor will take a few seconds to read that one sentence. Pique their interest with that subject line and you’re in business.

Step 3. Tell them what you do.

We know that a great cold email can be cancelled out by a bad subject line. What far too many founders seem to ignore is that the reverse is true as well.

Even if you have a great subject line that’s skyrocketing your open rates, if the body of your email is bad, all those opens will amount to, well, nothing.

Just because you’ve gotten someone to open your email does not mean you have their undivided attention for as long as it takes to read every single word you’ve written. If your email is text-heavy and looks boring, it’s not going to get read. It’s going to get sent to the trash can.

Keep the momentum going.

The subject line piqued their interest and got them to click; now it’s time to expand on your primary value proposition. You need to tell the investor what your company is all about quickly and in language they don’t have to think about.

You want to avoid boring cookie-cutter templates in your subject line, and the same goes for the first few sentences of the email itself.

If you lead with this:

“Hi [THEIR NAME], my name is [YOUR NAME] and I’m the founder and CEO of [COMPANY NAME]. I have been an entrepreneur for XX years and previously worked with [COMPANY X], [COMPANY Y], and [COMPANY Z]. I attended [UNIVERSITY] in [YEAR] and obtained a master’s degree in—”

… Deleted!

Here’s the harsh truth about cold emailing investors:

They don’t care about who you are right now.

If you lead with something they don’t care about, they won’t be around long enough to get to the parts they do care about. Tell them what your company does in a sentence or two, then shift the focus to the fourth step:

Step 4. Tell them why they should care.

By now, you’ve piqued the interest of your potential investor and given them a quick overview of what industry you’re in and what your company does. The next question you need to answer is this:

Why should they care?

If you want to eventually bring this person on as an investor, you need to convince them that what you’re doing matters and is worth paying attention to. To do that, there are a handful of things you can include in your email:

1. Social proof

If you have valuable testimonials from other well-known investors or influential people in the industry, mention them. If a person that’s well-respected by the investor you’re emailing has positive things to say about you, that social proof can be what encourages them to jump on a call with you to learn more.

2. Press mentions

Have you been featured in any well-regarded publications like TechCrunch, Forbes, or Business Insider? If you have, be sure to mention it, with a quick quote if you have the room. Media features act as a stamp of credibility for your company.

3. Key stats and numbers

What research-based evidence do you have to support the industry you’re in, what you’re doing, and how well you’re doing it? For example, if you’re building a mobile app, give numbers to explain why startups are going mobile-first, like the fact that 95 percent of Americans now own a cellphone.

4. Pitch deck

When it comes to attaching your pitch deck to a cold email, there are two popular viewpoints. On one hand, founders don’t want to seem pushy and send a deck without permission. On the other hand, attaching a pitch deck gives the investor easy access to more information on your company without having to ask for it.

Here’s my take: If you make them ask for your pitch deck, all you’re doing is creating another opportunity for your email to get deleted. Include your deck, let them look through it if they’d like, but keep the focus on this one thing:

Step 5. Set up a conversation.

When you send a cold email to an investor, you should have one goal, and one goal only. You’re not trying to sell them right away, you’re not asking for money right then and there. All you want to do is this:

Set up a one-on-one conversation.

You’re not going to close an investor through email. The goal of your cold email is to get on a potential investor’s radar, and schedule some time to hop on a call with them. Every cold email you send should have a call-to-action, and that call-to-action should be short and sweet:

“Are you free for a quick call in the next week?”

Once you get them on the phone, you can dig deeper into your pitch and answer any questions they have for you. When it comes to facilitating this call, keep this one thing in mind:

Never ask them to book time with you.

You need to be the one who schedules the call, and at a time that works best for them. Even if they agree to jump on a call, there’s a good chance they won’t actually care enough at this point to schedule the call themselves. Make the process as pain-free as possible for them, and your chances of getting them on the phone will go up.

Now Over To You

Cold emailing doesn’t have to be a big, scary beast you avoid at all costs. The truth is, the more cold emails you send, the better you’ll get at it, and the more results you’ll drive.

Remember, you’re not going to close every single investor you email, and that’s perfectly okay. The key is to do your research beforehand to make sure you’re only emailing the investors who are most likely to be interested in what you’re doing, and then focus on setting up that conversation.

Here’s a quick recap of the 5 key cold emailing steps to follow:

- Do your research

- Lead with value

- Tell them what you do

- Tell them why they should care

- Set up a conversation

Not sure who to reach out to? The MindSea team put together a list of the top 10 VC firms with the mobile Midas touch that you can download for FREE right now.