Did you know that $254 billion was invested globally into startups in 2018?

Would you like some of that money invested into your own business?

We’re going to guess that you would, and one of the best ways to make this happen is by creating a pitch deck that connects well with target investors.

What’s a pitch deck? Well, it’s a presentation used to provide your audience with an overview of your business plan.

A pitch deck tells a story. It introduces you and your company, demonstrates marketability and lays out the hard numbers.

Developing a pitch deck that connects with investors can be the difference between receiving millions in funding or sitting on the sidelines for months, knocking on doors and trying to gain traction.

It’s an important step, especially if the one thing sitting between you and launch is more capital, and it can be intimidating.

Today, I’m going to break down an easy-to-follow pitch deck formula that you can use for putting together your next investor presentation.

Let’s get started:

Here Are The Key Pitch Deck Components

In our experience, most seed stage investors focus on three main pillars: market, people and product.

Market-Related Components

One of the first things you want to do is determine the size of the market and the share you may be able to obtain. Without this, you cannot be sure you have a valid business model, and you won’t be considered by investors.

Startups need to understand how much value they can capture at a per-unit level. And this is called unit economics of scaling.

You’ll also want to look at any early leading indicators of capturing this market share, and how this relates to the value of one customer (Lifetime Value (LTV) to Customer Acquisition Cost (CAC)). The LTV is the average revenue a customer is predicted to make while CAC is the average expense of gaining that customer.

Product-Related Components

When you explain your idea, you need to explain what problem it’s solving. What are your customers’ pain points?

Yes, some products don’t fix any problems, but the best ones do. For example, vitamins are great, but people actually need painkillers to function.

To have a great painkiller, you need to understand the pain. People are less willing to pay for something they simply like, or that performs an arbitrary function, than they are something they truly need. Understanding the pain and knowing what it takes to fix it, is key to building the right app. In your pitch, you want to demonstrate how your app satisfies your audience’s needs.

Ask yourself how your startup is positioned to help people’s pain points. The better you are at with explaining the problem, the more convincing you will be.

Be a painkiller, not a vitamin.

Next, you will want to determine a product-market fit and what leading indicators you’re using to gauge it. Proving this confirms that you have identified a target customer and can serve them with the right product.

Team-Related Components

During your presentation, you also want to highlight your team and the skills, experience and network they bring with them. Place a heavy emphasis on your strong internal dynamics – highlighting work ethic, teamwork and personality.

Their impressions of your team may be just what an investor needs to convince them you have what it takes.

Remember, every pitch deck will be unique, but the ideal structure will weave various components of these three groupings into the slides. Here, we break down a typical flow:

Slide #1. Cover Slide

Your first slide gives you an opportunity to set the stage correctly. The goal of this slide is to set the tone for the presentation and get investors’ attention.

You don’t want to cram too much on this slide either. The slide should include your logo and tagline, website, contact email, the name of the company the deck is prepared for, and the date.

Slide #2. Your Story

You’ve probably heard the saying “facts tell, but stories sell.”

Storytelling is a powerful technique that should be incorporated into any presentation, and this is especially true for a pitch. You want to form a compelling narrative and take these potential investors with you on a journey – so start by telling them (and showing them) what you’re all about. There’s a human behind every successful product – don’t be afraid to get creative and show them who that is!

Slide #3. Your Value Proposition

What is your brand/product all about, how does it serve your customers, and why is it better than the competition?

Your answer is your value proposition.

A value proposition tells the market why they should choose you. To the same tune, it tells investors why they should invest in you.

For example, Lyft targets two groups of people with two distinct value propositions. One speaks to those who want to get a ride, whereas the other speaks to those who want to provide them.

Slide #4. The Pain

For your product to ultimately succeed, it needs to solve an existing problem. What is your product offering that is leaving a potential user in a better position than they were before they started using it?

The better you are at explaining what the problem is, the more successful you will be at convincing investors that the market is in need of your solution.

Slide #5. The Solution

Where there’s a problem, there’s a solution.

Now that you’ve shared the problem, you can present the solution and how your product fixes it.

Show how it can solve a customer’s challenge. Showcase the features that make it stand out. And highlight how your product is unique and stands out from the competition.

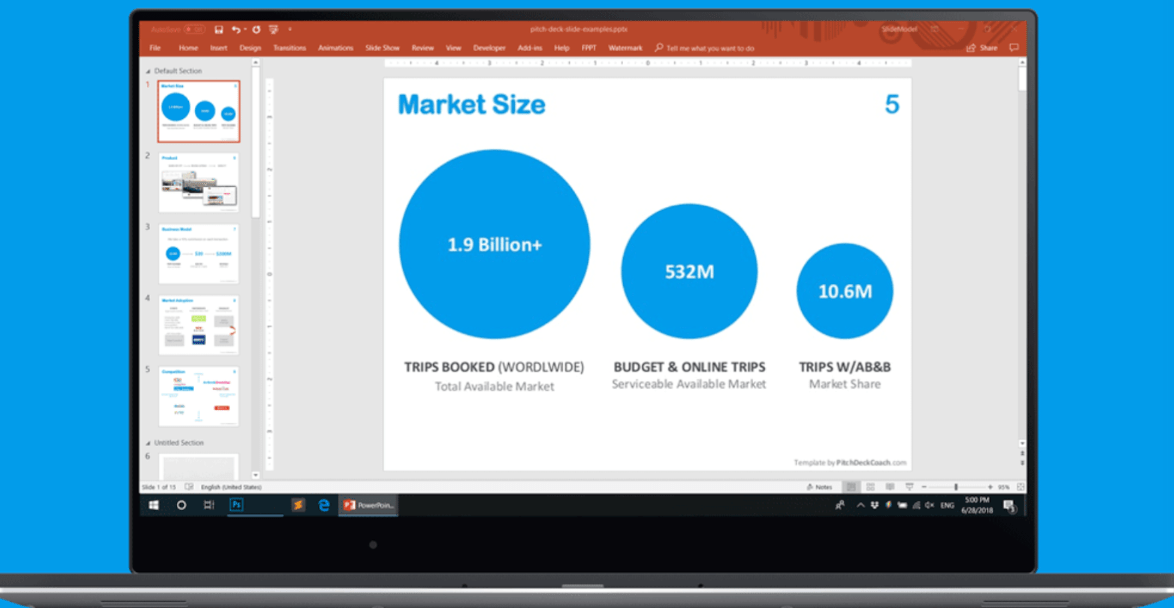

Slide #6. The Market

Next, you’ll want to highlight your market size and product-market fit. This demonstrates the potential value the market can have for your business.

When explaining your market size, you want to avoid claims that promise big returns. Rather, ensure your pitch deck highlights segmented estimates, like:

- Total Available Market (TAM): The total market demand for a product or service.

- Serviceable Available Market (SAM): Which part of the TAM that your product or service targets in your geographical area.

- Serviceable Obtainable Market (SOM): The part of your SAM that you can capture.

You want to outline not only what the market looks like today, but also what it’s forecasted to look like in the future—how it’s projected to grow.

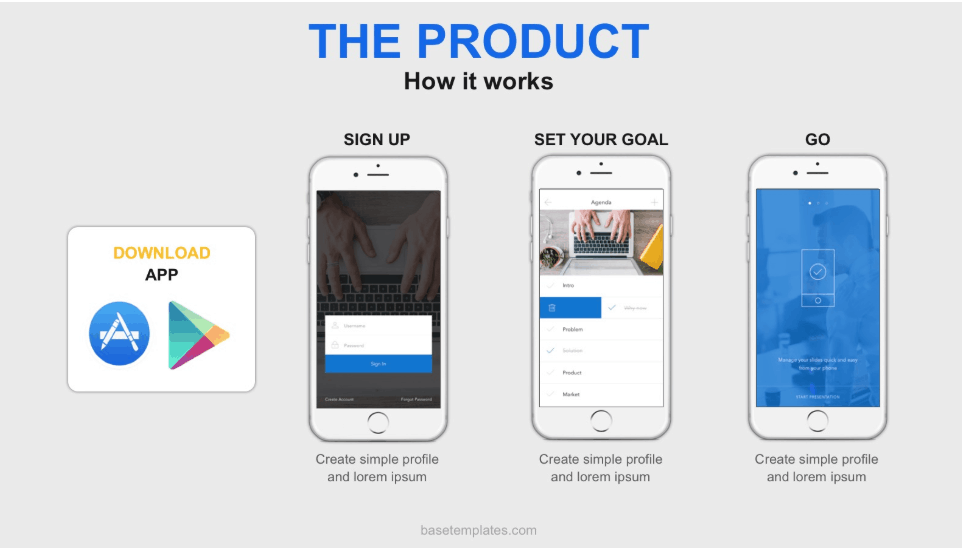

Slide #7. Your Product

Here is where you officially share what you’ve been building.

To make it effective, you should add sketches, wireframes, screenshots, etc. You should also, include a description. If you have a prototype to share (which I highly recommend), this is the point where you’d want to pause and conduct your demo.

Product demos provide an opportunity for you to enhance the quality of your pitch. When investors can see the app in action, they can gain a better understanding of its value and potential, by providing additional context on how it will achieve what you’ve already highlighted from a solution standpoint.

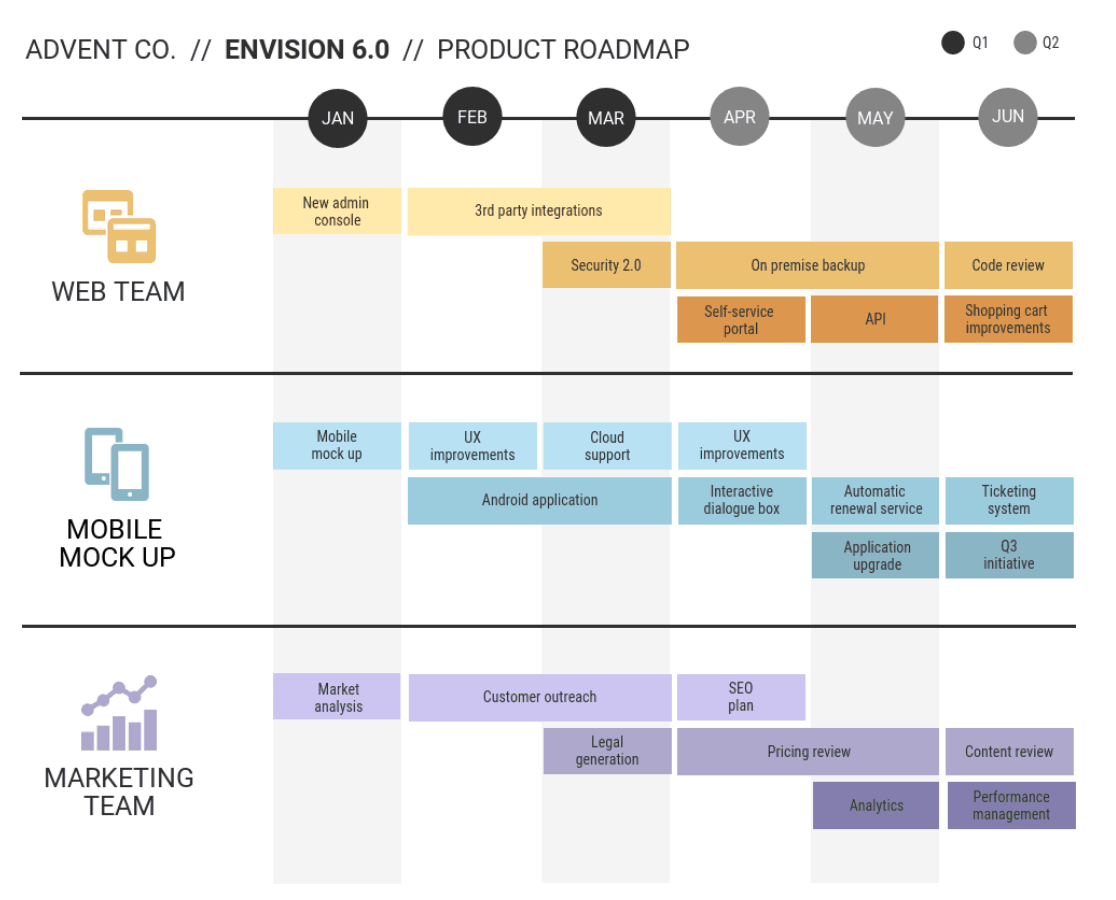

Slide #8. The Product Roadmap

A product roadmap is a visual that lays out the evolution of your product over time. The roadmap provides details on what the development team is building, timelines of features, integrations, etc.

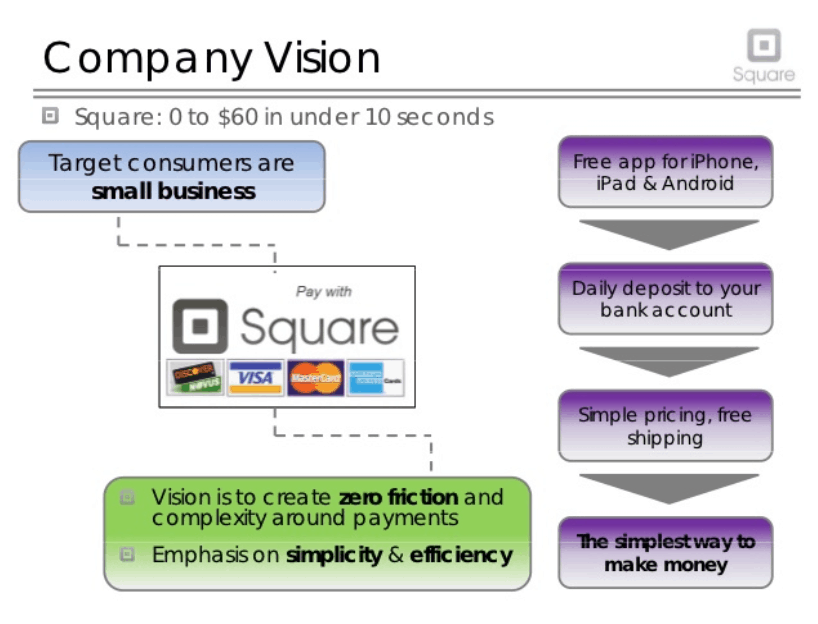

Slide #9. Your Vision

This is a quick overview of what you want your company to be and how you want to get there. You want it to be short and sweet, like a 20-second elevator pitch.

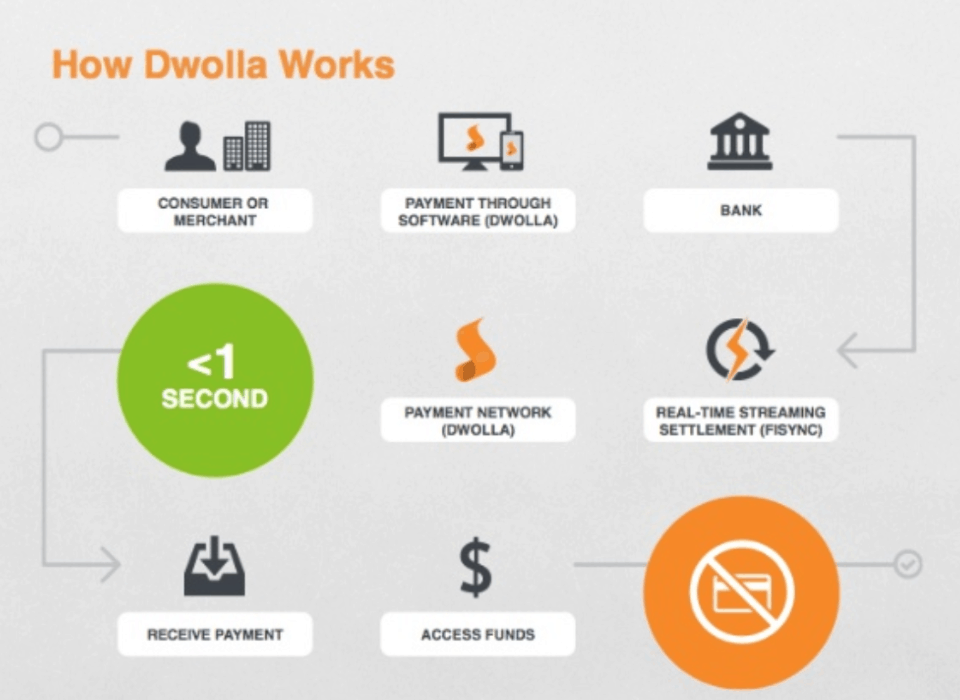

Slide #10. A Monetization Plan

If you’re expecting investors to shell out serious cash for your product, you’re going to want to highlight how you plan to make them money in return. Whether you plan to charge users to download your app or explore other monetization strategies, you want to address this directly.

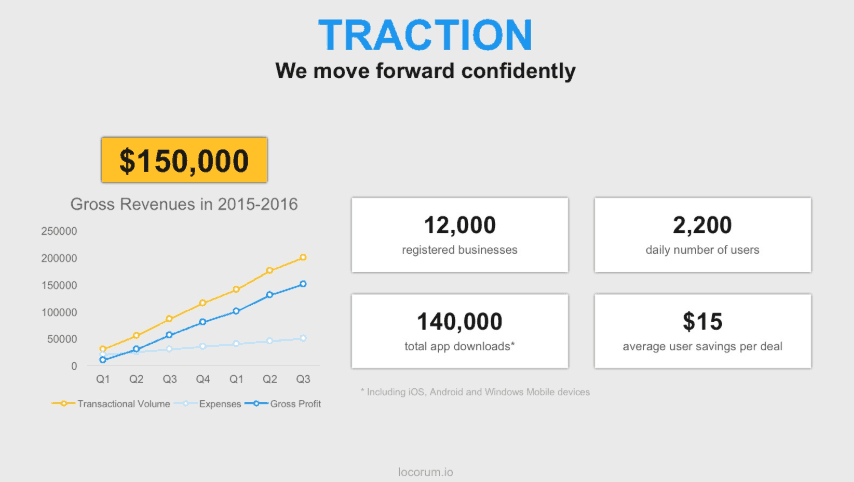

Slide #11. Traction

No, traction doesn’t mean the treads on your winter tires. In the world of startups, it’s referring to the success you’ve seen so far – proof that you are making moves toward your original hypotheses.

Have any successes to brag about so far? Share them in your pitch!

Usually, the best way to present this is as a graph which shows how many customers you have and how much they’ve been spending on your product. You want it to demonstrate growth over a period of time.

But it’s not all about revenue, perhaps your growth thus far is measured by downloads or sign-ups.

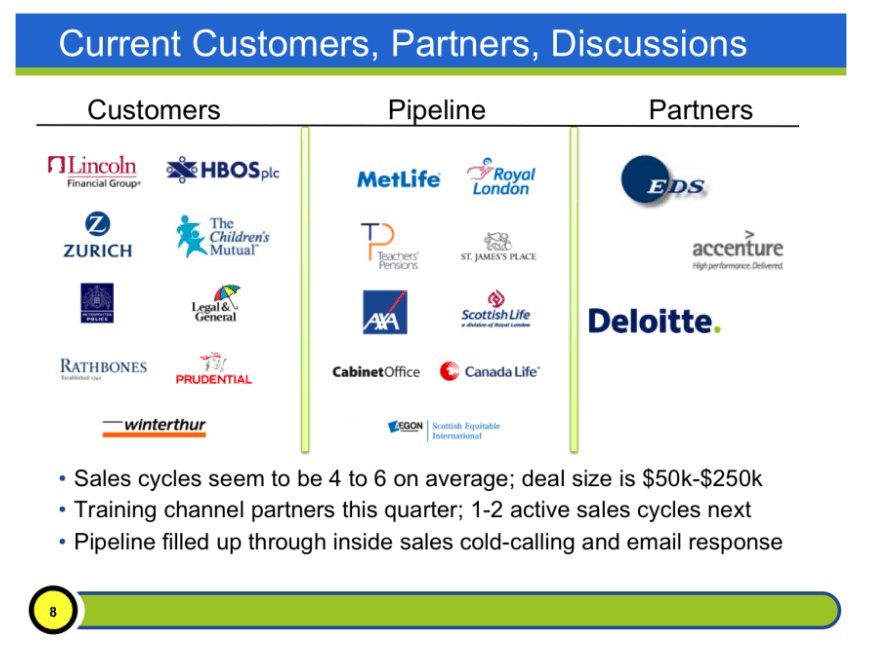

Slide #12. Your Customers

Have paying customers already? Show them off by mounting their logos on the screen to give yourself a boost in credibility.

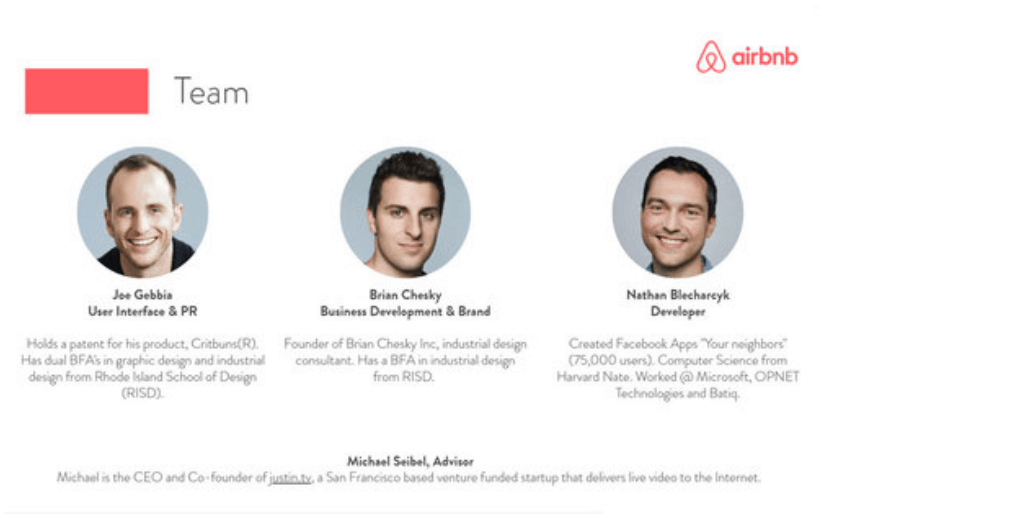

Slide #13. Your Team

Use one of your final slides to highlight the team members that are bringing this mobile app to life. Share their photos and bios, and demonstrate the expertise they bring to the table.

Slide #14. The Competitive Landscape

The company’s competitors will always be an issue for investors. You want to differentiate yourself from the rest so that they understand what makes your business unique.

To acknowledge your awareness here, you want to include a slide that plots your performance against that of your largest competitors. The metrics chosen are defined by users in the existing space, meaning showing a price/competitive advantage. Start with axes that are standard for your industry – for an app, your axes might be low price vs. high price, or hybrid app vs native app.

*Note: This slide might not be appropriate if you are a startup creating new market segment.

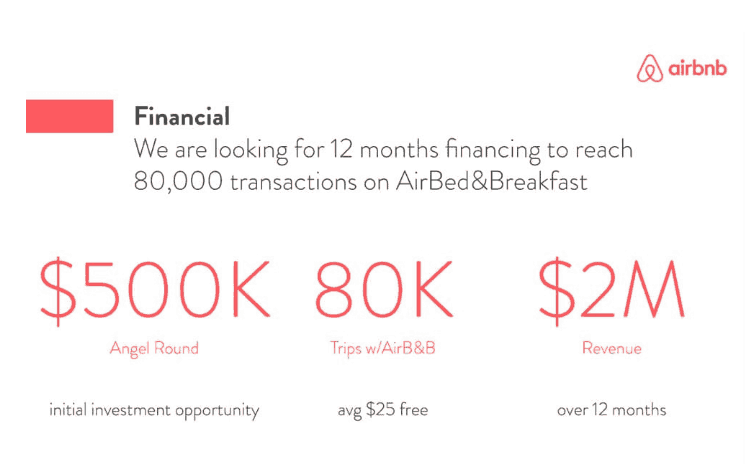

Slide #15. Funds Being Raised

Ok, time to ask for the cash.

Even if you have an idea of how much capital you’re looking to secure, provide a target range rather than a specific amount. For example, if you would like to raise $6 million, it would be ideal to put a range between $3 million to $6 million. By giving investors a range, you are opening yourself up to attract as many people as possible.

And if you have already raised funds up to this point, be sure to include how much, where it came from, and where it will be used. Likewise, you’ll want to explain how you plan to use any of the new funds you’re requesting (for sales, development, etc.).

Slide #16. Your Financials

Another thing investors are going to be concerned about is your company’s current financial situation.

The “Financials” slide often includes:

- Three to five-year financial projections

- Unit economics of scaling

- Lifetime Value (LTV) to Customer Acquisition Cost (CAC)

- Burn rate

- Key metrics that are important to your company

- Total revenue and expenses

Make sure your projections are realistic. You don’t want prospective investors to question them.

Slide #17. Your Contact Information

Just leave the basics: Your email, phone number, and a secondary contact person.

Wrapping Up

Pitching to an investor can be intimidating, but you can overcome any fear through proper preparation. When you come prepared and confident, you put everyone in the room at ease and open up the floor for a great presentation and discussion.

To recap, in order to have a good pitch deck, you need to include the following in your slides:

- Cover Slide

- Your Story

- Your Value Proposition

- The Pain

- The Solution

- The Market

- Your Product

- The Product Roadmap

- Your Vision

- A Monetization Plan

- Traction

- Your Customers

- Your Team

- The Competitive Landscape

- Funds Being Raised

- Your Financials

- Contact Information

Your next step is to act.

Whether it’s following VCs on Twitter or attending an event filled with investors, you have to stay active or you won’t get noticed.

If you’re interested in learning more about the app-building process or want some help building a successful app, reach out and chat with one of our product strategists—we’d love to work with you.